Join our Telegram channel to stay up to date with the latest news

There is no directional guidance for Bitcoin (BTC) price, but all signs point to bears taking control. The major cryptocurrency continues to trade with a balance of $29,398. Market watchers and experts comment on these price movements. In their view, if BTC creates a breakout candle near the above level within four hours, it would be disastrous for traders.

$BTC / $USD - Update

I knew that would happen and that we would remain above parity at the end of the week. Up 0.01% yesterday so my eyes are on #altcoin for now and I've set an alert if we drop below the offset on #bitcoin pic.twitter.com/ybJ1ngxLHS

— CryptoTony (@CryptoTony__) August 13, 2023

Expert opinion on why bitcoins are down

According to industry experts, the Bitcoin price has been stuck for one reason: a lack of momentum.

Lack of momentum/motivation

The lack of motivation to increase Bitcoin's price comes as the US Securities and Exchange Commission continues to delay orders for BTC exchange-traded funds (ETFs). Cathy Wood, CEO of Ark Invest, has expressed her hope that the committee will approve several one-time applications for BTC at once. In a recent development, the SEC has indicated that a delay may occur, leaving room for public comment.

The SEC is (as expected) delaying a final decision on #Bitcoin ETFs.

There are 56 cases of the word “rigged” in SEC filings… Apparently, applicants must prove that BTC is not a “rigged” asset class before a spot ETF can be approved. pic.twitter.com/ham63WPr8D

— tedtalksmacro (@tedtalksmacro) August 11, 2023

The committee's press release lists several occurrences of the word "manipulation." Experts say this may be a new approach to declining deposits. According to the press release, the agency requires institutions that have applied for approval to prove that BTC is not a manipulated asset class. A paragraph in the log states:

The panel asked commentators to consider whether the statements made by the exchange in support of the proposals were sufficient...

It should be noted that August 14th is the deadline for making a decision on the immediate application of the Ark Invest BTC ETF. With release, that date may have been pushed back, with some speculation regarding the decision in 2024.

If tampering turns out to be a criteria for approval, it would be added to the list recently made by former SEC chairman Jay Clayton. In his interview with Fox Business, Clayton said that if the nomination proves successful, the agency will likely approve it.

PAK IN: 🇺🇸 Former SEC Chairman Says #Bitcoin Spot ETFs Should Be Approved. pic.twitter.com/szb6vTzpLj

- Watcher.Guru (@WatcherGuru) July 10, 2023

However, BTC can be manipulated as it is an international asset with players from all over the world. The Securities and Exchange Commission may be able to enforce regulations in the United States. However, the actions of overseas players can still affect bitcoin prices in the US. (And

Gig issues can be a hindrance to Bitcoin ETF implementation updates

In the latest news regarding BTC ETF filings, analysis by Bloomberg believes that the SEC will delay any decision. This is despite the fact that deposits of the Bitwise Bitcoin ETP Trust and Bitcoin ETF from BlackRock, VanEck, WisdomTree, and Invesco are expected on September 1st.

John Reed Stark, a former SEC official, also cast doubt on the possibility of approval, saying the odds are higher if a Republican president takes office.

Will the SEC Approve a New Spot ETF Bitcoin Application?

I am frequently asked whether the SEC will approve recent bitcoin ETF filings, which is an interesting and important question.

I suspect the current SEC will... pic.twitter.com/lPXebl03Y4

- John Reed Stark (@JohnReedStark) August 13, 2023

The gist of Stark's claim is that Democrats currently make up the majority of the SEC's team of commissioners. If a Republican president is elected in the 2024 election, Crypto's mother, Hester Pierce, will serve as interim president during the transition period. Stark says this would allow him to level the playing field and create fair opportunities for positive crypto recommendations and payout cuts.

Consider the Bitcoin ETF as a potential catalyst for Bitcoin and cryptocurrency prices

The common belief is that the SEC's approval of instant BTC ETF deposits will provide the necessary boost to start the market. Yann Allemann, co-founder of Glassnode and CEO of Swissblock Technologies, has called for a "reorganization of the industry." According to him, this will lead to a new wave of capital inflows.

Meanwhile, traders and investors anticipate the approval of the ETF as a potential market leader. As long as the SEC delays a decision, the price of bitcoin may remain set. Worse, the momentum could falter even as analysts expect a retest of the $27,000-26,000 range.

Bitcoin price analysis related to BTC and balance

As volatility decreases, bitcoin price is moving along the balance line on the 4-hour chart. One could easily confuse this with the weekend mood and low trading volume. However, it cannot be overlooked that whales also sit on their hands.

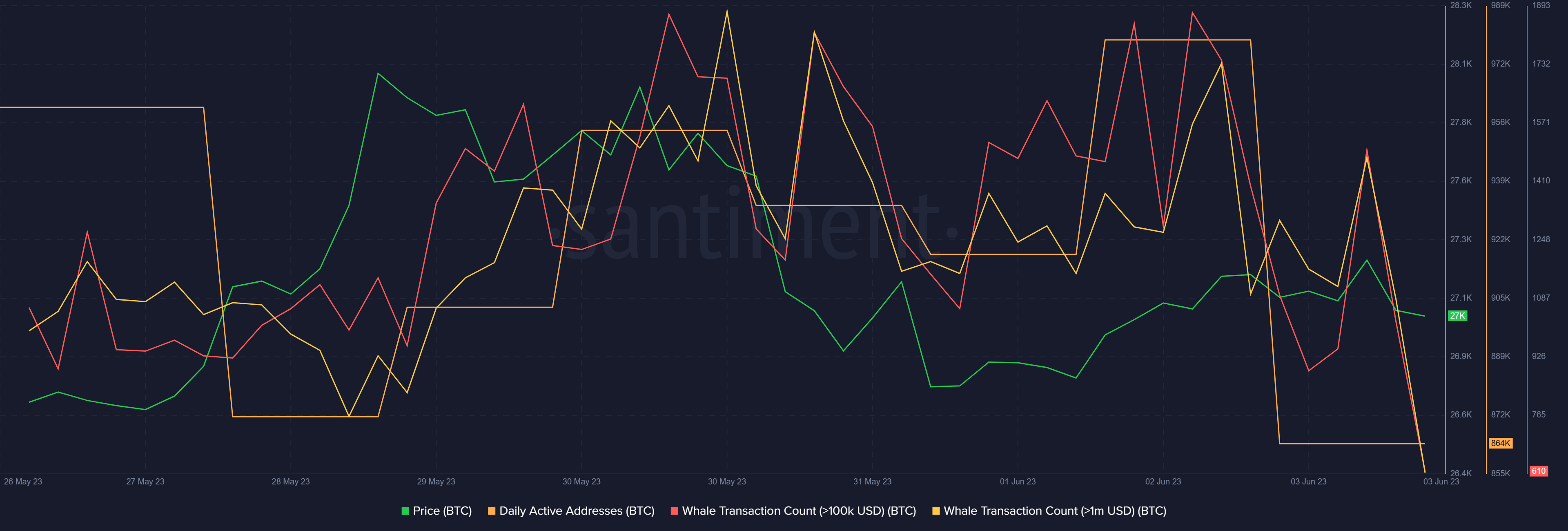

Sentiment data shows that major owners' whaling deals of more than $100,000 and a balance of $1 million have been steadily declining since May. The same applies to the number of daily active addresses, as shown in the table above.

If the bullish momentum does not improve, bitcoin price could decline and initially lose support from the 50MA at $29,365. That could mean a drop to $28,998 or, at worst, a retest of the August 7 low at $28,806.

The impressive relative strength index (RSI) and momentum indicators (AO) support the bearish thesis. Based on their overall view - RSI heading south and AO negative - momentum is fading. This means that the bears are in charge.

On the other hand, if new capital flows into BTC, it is likely that due to the accumulation of large owners, the price of Bitcoin may go up. On such a move, the major cryptocurrency could breach the 200 MA at $29,640 or, in particularly strong cases, extend north to locate the $30,052 resistance.

As the Bitcoin price struggles to break even, consider XRP20 as a more promising alternative.