Join our Telegram channel to stay up to date with the latest news

Investors breathed a sigh of relief after Wednesday's terrible sell-off. Surprisingly, Bitcoin drove the entire market down, losing at least 4.2% of its total market capitalization to $1.05 trillion.

Cryptocurrency market in chaos

While there could be many reasons behind this crash, which saw BTC drop 4.2% in 24 hours and trade just above $25,000 on Thursday, the Federal Reserve's decision to temporarily suspend interest rate hikes is the main culprit.

The pause in rate hikes is a positive sign, but comments by chief regulator Jerome Powell after the announcement appear to be unnerving the market.

Powell reaffirmed the Fed's commitment to keep annual inflation at 2.5% from the current 4%. However, opponents of the bank's strategy believe that an excessive emphasis on price stability could inevitably drag the economy into recession.

In addition, the crypto market has been in chaos since last week after the US Securities and Exchange Commission launched another crackdown on crypto companies, including Binance and Coinbase.

In doing so, the SEC cited 64 cryptocurrencies and listed them as security offerings, including Cardano (ADA), Polygon (MATIC), and Solana (SOL).

Lawsuits against Coinbase and Binance are flaring up after another case of regulators fighting XRP issuer Ripple Labs.

Investors should give the market time to announce their possible direction, according to a related CoinDesk report citing Ruslan Lienkh, Web3 market leader and fiat services company YouHodler. This could be a bear trap set by one of the big whales who decided to sell BTC right now.

“We have to keep in mind that the crypto market is relatively small and a few hundred million dollars can move the market by a small percentage,” Lienha said in an emailed statement. "So we'll see in the coming days if this is really a downtrend or just selling individual whales."

Bitcoin whales survive: look at the price

The price of bitcoin tends to move in a four-year cycle. Large holders and institutions carefully manage this period and use it to increase their investments in cryptocurrencies.

These cycles are often marked by a Bitcoin halving occurring every four years. Halvings minimize inflation on the Bitcoin network by reducing the supply of the largest cryptocurrency.

Every four years, the miner's remuneration is halved. This reduces supply significantly, and with increased or even flat demand, the price of bitcoin eventually drives the bull market to all-time highs.

Check out our dashboard below for more on HODLer loops👇🏼https://t.co/6KJHVYjlg6 pic.twitter.com/Sw3TYYS4Up

— glass node (@glassnode) June 15, 2023

According to Markus Levin, co-founder of XYO Network, a geospatial blockchain protocol, Bitcoin has "already fallen" in terms of the dominant "four-year cycle".

“But nothing is certain in this market, especially when it comes to crypto,” Markus explains. “For example, when we enter bearish territory, we need to be prepared for more erratic moves in bitcoin and other assets further down the risk curve.”

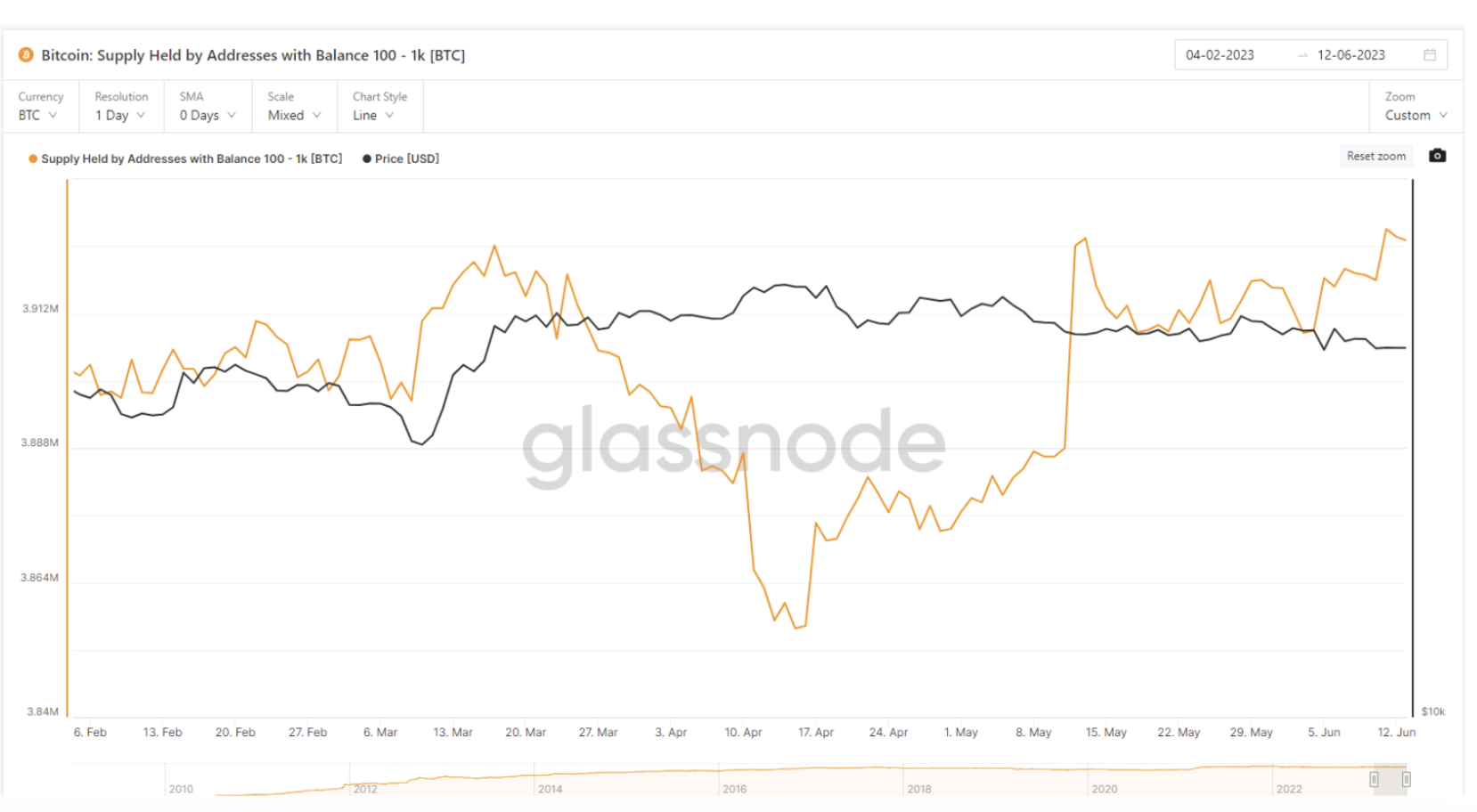

Glassnode, a network analytics company, has reported that unique wallets worth between 100 and 1,000 BTC have increased their holdings of BTC following SEC lawsuits against Binance and Coinbase.

Wallets with values between 10 and 100 BTC show a similar trend. However, risk appetite is not so obvious for wallets with more than 1000 BTC.

While the 1000-10000 BTC wallet group has declined slightly, the 1000-100000 BTC wallets have remained relatively unchanged.

A technical look at the price of bitcoin

If whales continue to sell, this decline will be temporary. Investors are also being encouraged to buy at the lows, allowing the price of bitcoin to use the new liquidity for a bigger jump towards the $30,000 target.

The four-hour chart is already showing BTC starting to rise above $25,000. According to the Balance Volume Indicator (OBV), investors have begun to invest more in the BTC market.

In other words, there is more positive liquidity to add bullish leverage to BTC. However, support at $25,000 should be maintained to avoid a potential drop to $24,000.

Related article:

Wall Street memes are the next big cryptocurrency

- Presale: Early Access Now Available

- An association of exchange and cryptocurrency traders has been created

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Meme is chosen as the best cryptocurrency to buy in the coin industry

- OpenSea NFT Collection Team - Wall St Bulls

- Reply to a tweet from Elon Musk

Join our Telegram channel to stay up to date with the latest news