Join our Telegram channel to stay updated with the latest news

There is considerable volatility in the cryptocurrency market following a significant drop in the value of Bitcoin. Traders are cautious ahead of the US Federal Reserve meeting. There is uncertainty affecting Bitcoin and other cryptocurrencies.

The cryptocurrency market has been experiencing volatility since the fall of Bitcoin

The cryptocurrency market continues to show volatility after Bitcoin's sharp fall that saw it hit a three-month low.

Uncertainty among investors has led to a lack of price momentum for Bitcoin and other major altcoins. This volatility pushed the Tether USDT stablecoin from its $1 value. The created situation reflects the impact of several factors on the market.

Bitcoin, the largest cryptocurrency by market capitalization, traded around $25,550 in the last 24 hours. Although it remained relatively flat during this period, it spent most of Thursday in negative territory.

Bitcoin's drop below the $25,239 mark on Wednesday marked the first time Bitcoin has fallen below that level since mid-March. The cut was likely in response to aggressive monetary policy by the Federal Reserve, even as the central bank suspended interest rate hikes for the first time in 14 months.

Bitcoin was hovering around $26,000 a few weeks ago.

Bitcoin Traders Cautious Ahead of Fed Meeting Amid Expectations of Flat Rate and Future Rate Hikes

Bitcoin traders are cautious ahead of the US Federal Reserve meeting, expecting interest rates to remain flat but with signs of a possible hike in the future.

Previous interest rate hikes and Fed balance sheet reductions have had a negative impact on risk assets, including cryptocurrencies. Traders are eyeing another rate hike in July, but have scaled back expectations for a rate cut later this year.

Options data is bearish on the market, with bitcoin trading higher than the bulls. While recent inflation data gives the Fed room to keep interest rates steady, headline and core inflation remain above the central bank's target, limiting the possibility of an end to the tightening cycle.

Positive real interest rates tend to have a negative impact on zero-yielding assets such as Bitcoin, which have historically been negatively correlated with real returns. Traders may not trust stock market movements following the Fed release as an indicator due to the weakening correlation between Bitcoin and stock indexes.

A Federal Reserve jump could be seen as limiting expectations, which could lead to lower interest rates and higher Bitcoin, but not necessarily a significant price move.

Ether and Tether are following Bitcoin's downtrend

The second largest cryptocurrency by market cap, Ether (ETH), has also slowed in recent days. Its price has remained relatively unchanged and is currently hovering around $1,655, mirroring the trends seen on Wednesday. Like Bitcoin, ETH hit three-month lows during this period. However, there is volatility, which means volume remains high.

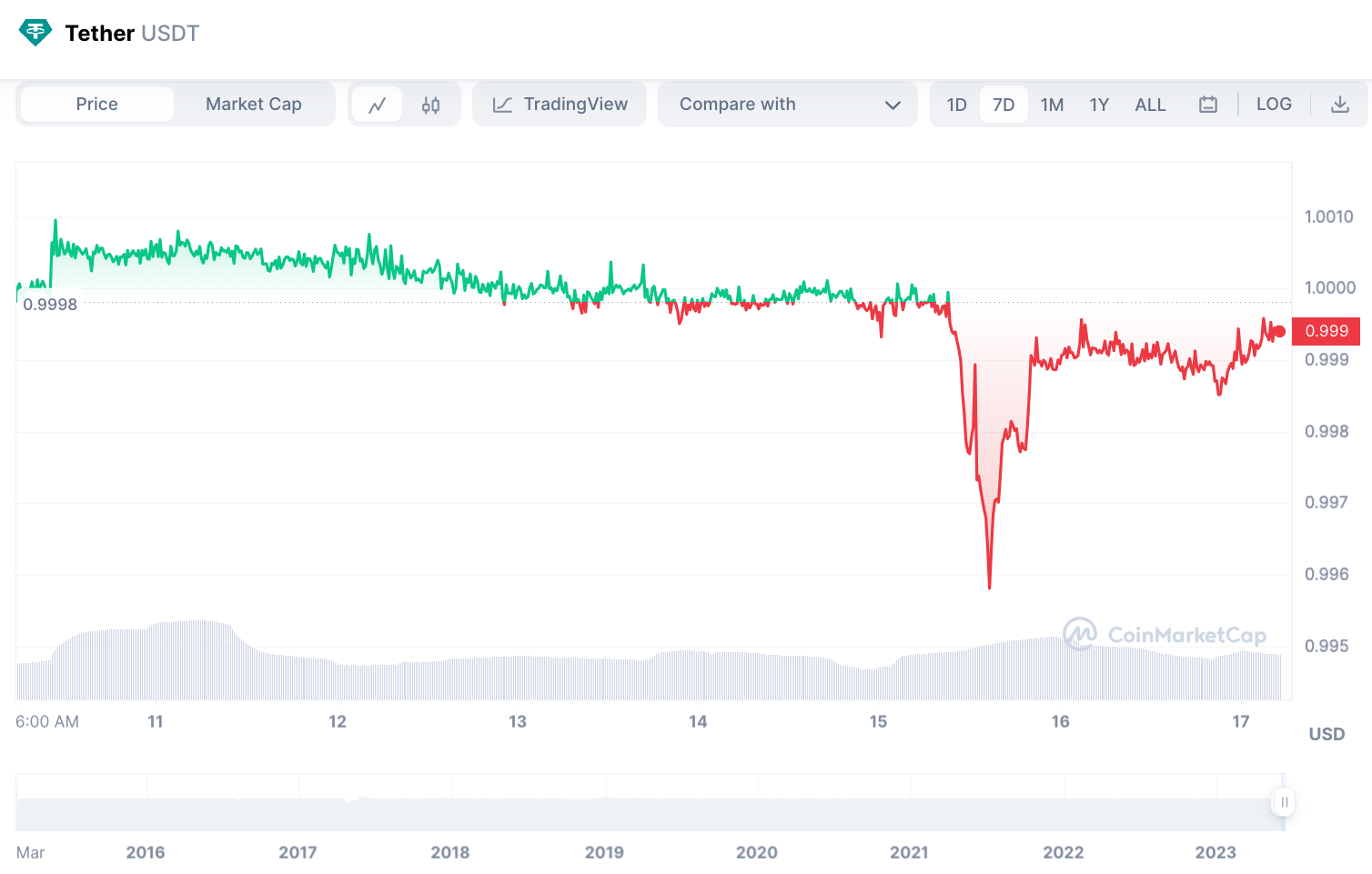

In addition to Bitcoin and Ethereum, the USDT Tether stablecoin was also affected by the market decline. USDT experienced a rejection of $1 on Thursday mainly due to selling on popular platforms such as Uniswap and Curve pools.

USDT fell as low as $0.9968 before recovering to its current trading value of $0.999, according to data from CoinMarketCap.

Regulatory concerns and uncertainty over Tether's stability further unnerved investors. This is especially important given Tether's dominance in recent months. The USDT crash had a big impact on the markets.

Market trends and future challenges

A fall in the cryptocurrency market over the past two days led to a breakout in US stocks, which showed a positive trend on Thursday. Investors were reassured by encouraging economic data, such as an increase in consumer spending in May, suggesting a recession is not imminent.

The Nasdaq Composite and S&P 500 technology indexes rose 1.1% and 1.3%, respectively. However, cryptocurrencies did not follow the same upward trend and either stagnated or declined.

Vinit Bhuvanagiri, CEO of EMURGO Fintech, compares the current market situation to 2019. Then, the fact that there was a lot of volatility in a certain range caused mixed feelings among market participants.

Bhuvanagiri noted that uncertainty surrounding rising interest rates, slowing economic growth and potential problems in the banking sector could continue to weigh on the cryptocurrency market. This suggests that survival is likely to be the primary strategy for most participants until macroeconomic conditions stabilize.

The coming months are expected to be volatile, requiring investors to be cautious and flexible.

Related posts:

Wall Street Memes is the next big cryptocurrency

- Direct Early Access Presale

- A community of exchanges and cryptocurrency traders has been created

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Meme has been recognized as the best cryptocurrency to buy in the coin sector

- OpenSea NFT Collection development team is Wall St Bulls.

- Elon Musk responded to the tweet.

Join our Telegram channel to stay updated with the latest news