Add and shift Gen Z investors like cryptocurrencies, gold and bank stocks, according to New Apex Investor Research Q1 2023 .

- The Apex Next Investor Outlook report shows the next generation of investment trends

- The data shows a surprising response to SVB broadcasts.

Added a disclaimer after the last paragraph of the May 31, 2023 edition:

This press release contains multimedia. See the full release here: https://www.businesswire.com/news/home/20230531005239/am/

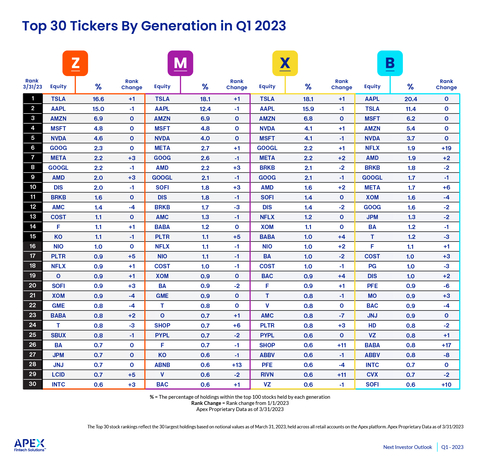

Top 30 tickets by generation in the first quarter of 2023. The Top 30 ranking represents the top 30 assets by fair value as of March 31, 2023 by all retail accounts on the X platform. ApexProperty data as at 31 March 2023, exchange rate change = exchange rate change on 1 January 2023 (Graph: Business Wire)

The updated version reads as follows:

GENERATION Z INVESTORS LOVE THE NEW APEX INVESTOR I Q1 2023 RESEARCH.

- The Apex Next Investor Outlook report shows the next generation of investment trends

- Data shows surprising response to SVB releases.

The Apex Next Investor Outlook (ANIO) Q1 2023 report reveals surprising intergenerational investment trends in response to key market drivers, including the aftermath of the Silicon Valley banking crisis and continued volatility in equities. Research uses data from Apex Fintech Solutions (“Apex”) to drive innovation in fintech and the future of digital wealth management. The survey revealed counter-trend data, including Gen Z's increased interest in gold and cryptocurrencies and willingness to buy bank stocks amid market uncertainty. banking sector.

The ANIO report analyzes data from investors who traded between January 1 and March 31, 2023, on 1.3 million Gen Z accounts and 5.6 million Millennial, Gen Z and Boomer accounts through brokers offering the Apex clearing platform.

The following information refers to the Apex ranking of the most traded securities by generation in the first quarter of 2023. The data shows the performance of a given ticker in this ranking system for a given generation. These observations are intended to inform generational trends and do not constitute investment advice. Key findings of the report include:

- The overall ripple effect of SVB: Generation Z investors were more concerned about banking uncertainty than other generations with direct experience of past financial crises. On March 29, the day the bank's stock hit a record high, Gen Z sold more securities than any other group of older investors.

- Millennials rock bank stocks : As older generations sell bank stocks, millennials buy them instead — Charles Schwab ( SCHW ) shares are 21 points above millennial levels, despite a nearly 33% decline in total market value. Millennials invested in First Republic Bank (FCRB), rising to 25 levels from Q4 2022.

- All generations agree on seven favorite stocks: Among all generations, the top seven holdings in retail accounts on the Apex platform are 1. TSLA 2. AAPL 3. AMZN 4. MSFT 5. NVDA 6. GOOG /GOOGLE 7 .META.

- Investors are bullish on gold: With global retail demand down 13% from the first quarter of 2022, investors in the Apex platform are more bullish. During the week from March 6 to 13, the nominal value of these investments increased by 560%.

- Gen Z still loves crypto and digital: In the first quarter, Gen Z's top three stocks included cryptocurrency company (COIN); Bitcoin ecosystem provider (MARA) and cyber security company (CRWD).

Gen Z investors were in high school when Lehman Brothers collapsed in 2008, so in many ways the Q1 banking crisis was actually the first real financial crisis for this generation, says Conor Coughlin, Director of Fintech Trading at Apex Fintech Solutions. "This generation will invest in innovators and pay for expected trends, and more than $70 trillion in assets will be transferred to this generation in the coming decades. Fintechs and advisors must understand the attitudes, needs and values of this digital and revolutionary generation."

About Apex FinTech Solutions

Apex FinTech Solutions is a financial technology hub that provides hassle-free access, hassle-free investing and investor education to everyone. Apex's comprehensive suite of solutions powers innovation and growth for hundreds of today's market leaders, competitors, innovators and visionaries. The company's digital ecosystem creates an environment where customers with big ideas can change the world. Through Apex Clearing™, Apex Advisor Solutions™, Apex Silver™ and Apex CODA Brands Markets™, Apex Partners strives to help its partners succeed at the forefront of the industry with customized custody and clearing, advisory, institutional, digital assets and SaaS. .

For more information and to download the report, visit: https://go.apexfintechsolutions.com/apex-next-investor-outlook-q1-2023.

Refusal

Investing is speculative, past performance is not indicative of future performance, future returns are not guaranteed, and initial capital loss may occur. Fluctuations in exchange rates may adversely affect the price, value or income of certain investments. The views expressed in this report are for educational and informational purposes only and should not be construed as research, analysis or a recommendation to buy or sell any particular security or product. Readers of this report should seek professional advice as to whether this information is appropriate for their particular investment situation and, where appropriate, tax advice. The aggregate data in this report includes specific account types that meet specific criteria defined by Apex (eg, individual accounts within a specific age group at a specific time). This information may not be reproduced or distributed in whole or in part without the prior express written permission of Apex. Furthermore, the information provided herein is subject to change without notice. The names and logos of financial and other organizations mentioned herein are not affiliated with Apex.

Media:

It is given

apex@fulvested.com

See the original issue on businesswire.com: https://www.businesswire.com/news/home/20230531005239/en/