Good morning. Here's what happened:

Price: After debt ceiling rise in crypto markets ends, bitcoin and ether fall sharply in East Asia. What is the next story for cryptocurrencies?

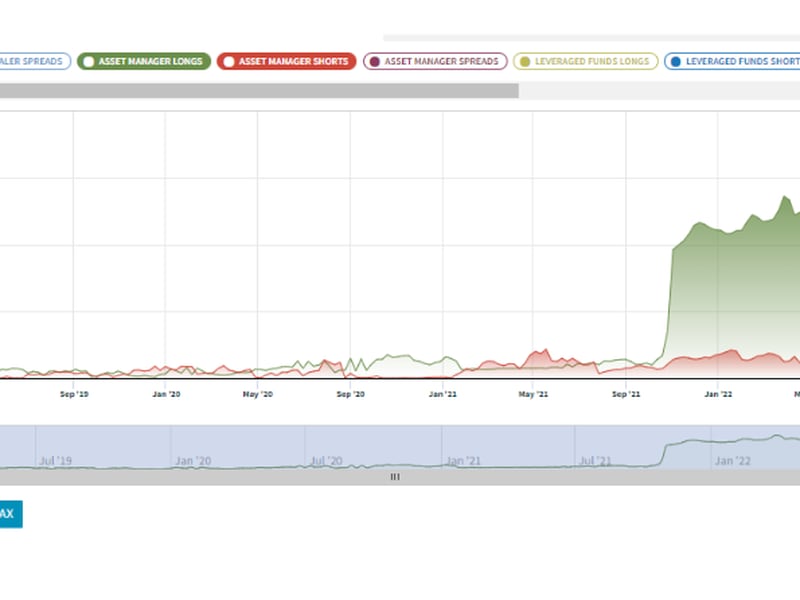

Outlook: The latest trader engagement report shows a recovery in open long positions among asset managers.

PRICE

| CoinDesk Market Index (CMI) | |

| 1.197 | −11.5 ▼ 1.0% |

| BTC (BTC) | |

| $27,746 | −354.3 ▼ 1.3% |

| Ethereum (ETH) | |

| 1893 US dollars | −21.0 ▼ 1.1% |

| S&P 500 | |

| 4205.45 | +54.2 ▲ 1.3% |

| bear | |

| 1960 US dollars | +15.9 ▲ 0.8% |

| Nick 225 | |

| 31233.54 | +317.2 ▲ 1.0% |

| BTC/ETH price for CoinDesk Index, 07:00 ET (11:00 UTC) | |

Looking for the next price history

Sam Reynolds

Good morning Asia,

Yesterday's post-debt rally ended.

Bitcoin started the trading day in East Asia down 1.3% at $27,746, while Ether fell 1.1% at $1,893.

In recent weeks, cryptography has struggled with storytelling issues. Lack of a defining narrative: Is it a risk asset or a risk hedge? - created random price swings and confused investors.

For example, one could argue that bitcoin should rise due to the uncertainty of the debt ceiling, because a US default would destabilize the traditional financial system. But instead, Bitcoin acts like a stock. Perhaps the cryptographic narrative is not a narrative at all after all.

Ed Moya, senior market analyst at OANDA, said the upcoming US election is a story to watch.

"We have been reminded that the key to Bitcoin's success in the US may lie in the upcoming presidential election," Moya wrote in a statement on Friday. "Florida Gov. Ron DeSantis Announces Plan to Run for President, Looks Ready to 'Defend' Bitcoin".

Since central bank digital currency is an emerging issue in Florida's political landscape, the next logical step is the national stage. Cryptocurrencies have appeared in elections around the world, such as in South Korea and Thailand, and President Joe Biden has talked about them in discussions about debt repayment.

Maybe it will be a story to watch?

The biggest winner

| spring | TICKER | return | DACS sector |

|---|---|---|---|

| XRP | XRP | +2.3% | rank |

| STAR | XLM extension | +0.6% | Smart contract platform |

The biggest loser

| spring | TICKER | return | DACS sector |

|---|---|---|---|

| Gala | GALA | -4.0% | Takes your breath away |

| The polygon | turned off | -3.5% | Smart contract platform |

| avalanche | AWACS | -3.1% | Smart contract platform |

Prospective

Funding rates remain positive in the cryptocurrency market

Author: Glenn Williams Jr.

The Trader Engagement Report shows that asset managers are increasing their open long positions in bitcoin after falling in the previous two weeks. An increase of 24 contracts followed a decline of 162 contracts a week earlier.

Growth was hurt by what appeared to be a decline in overall exposure, not price commentary. Asset managers also reduced their short positions during the same period, reaching 194 contracts.

The Commodity Futures Trading Commission (CFTC) releases weekly COT data detailing interest and open activity of asset managers, leveraged funds and brokers.

Asset managers account for 48.9% of open long positions and 97.25% of long assets on the Chicago Mercantile Exchange as a whole.

An important event.

17:00 HKT/SGT (9:00 UTC): European Commission Business Climate (May)

17:00 HKT/SGT (09:00 UTC): European Commission Consumer Confidence Index (May)

22:00 HKT/SGT (14:00 UTC): US Consumer Confidence (May)

TV table with coins

In case you missed it, here's the latest episode of CoinDesk TV's The Hash:

Lawyers behind FTX lawsuit discuss Shaq's service; The balance of Ethereum on the exchange is at an all-time low

The hosts of The Hash talk about the most important stories shaping the cryptocurrency industry today. The amount of Ether (ETH) on exchanges has hit a low not seen since July 2016 as the risk runs out of available Ether. Separately, potential signals that good economic news is bad news for digital asset price narratives are beginning to change. Additionally, attorney Adam Moskowitz, who represents some of FTX's investors, joined The Hash to discuss basketball legend Shaquille O'Neal, who is involved in a lawsuit involving FTX and its celebrities.

Name

Dogecoin Charts Suggest Rising Volatility: A technical analysis indicator called Bollinger Bandwidth shows that Dogecoin's unusual lull will end with a clear move in either direction.

Gemini and lender Genesis asked US court to drop SEC lawsuit against Earn program: The US Securities and Exchange Commission said the two organizations sold unregistered securities through the Gemini Earn program.

Short-term bitcoin holders resell profits: The resumption of profit for short-term holders is a positive sign of short-term price action, according to one observer.

Fantom will refund 15% token fees for selected projects – the move is part of an initiative to stimulate demand for the blockchain space, which helps increase the value of the FTM token.

Shiba Inu-themed Floki sees trading volume rise in Chinese countries: Floki prices rose on Sunday amid bitcoin-focused market momentum and bets on the token's "Chinese narrative."

This story originally appeared on Coindesk