Following the bankruptcy of the Singapore-based fund in July 2022, liquidator consulting firm Three Arrows Capital, Teneo, was hired to recover the fund through the sale of an NFT it owns.

On April 19, Sotheby's announced that it would be presenting the first part of the process with “Grails,” an auction of nine premium generative digital works that will form part of the auction house's contemporary and modern art sale, which will take place from April 6. The auction will be held until May 20.

Dmitry Cherniak, (2021). Image courtesy of Sotheby's

"We chose to partner with Sotheby's digital art team because we believe they offer a world-class approach that will ultimately maximize the value of these assets for all borrowers," Teneo said in a statement to Artnet News. The collapsed crypto fund still owes around $3.5 billion to its creditors.

Founded in 2012, Three Arrows Capital has backed several high-profile projects, including BlockFi and Polkadot, whose founders describe themselves as brilliant private investors. As Zhu and Davis rose to fame on crypto-Twitter, they began to amass a collection of NFTs worthy of their high status. Part of that effort was working with renowned NFT collector Vincent van Doff to launch the fund Starry Night Capital, which promises to "put together the finest collection of crypto art in the world."

Although the NFTs from the so-called Starry Night portfolio will not be auctioned due to ongoing complications surrounding their ownership, the works for sale at Sotheby's are indeed works worthy of the exhibition title "Grails", which translates to a work of historical interest in the NFT snake. It maintains their standards.

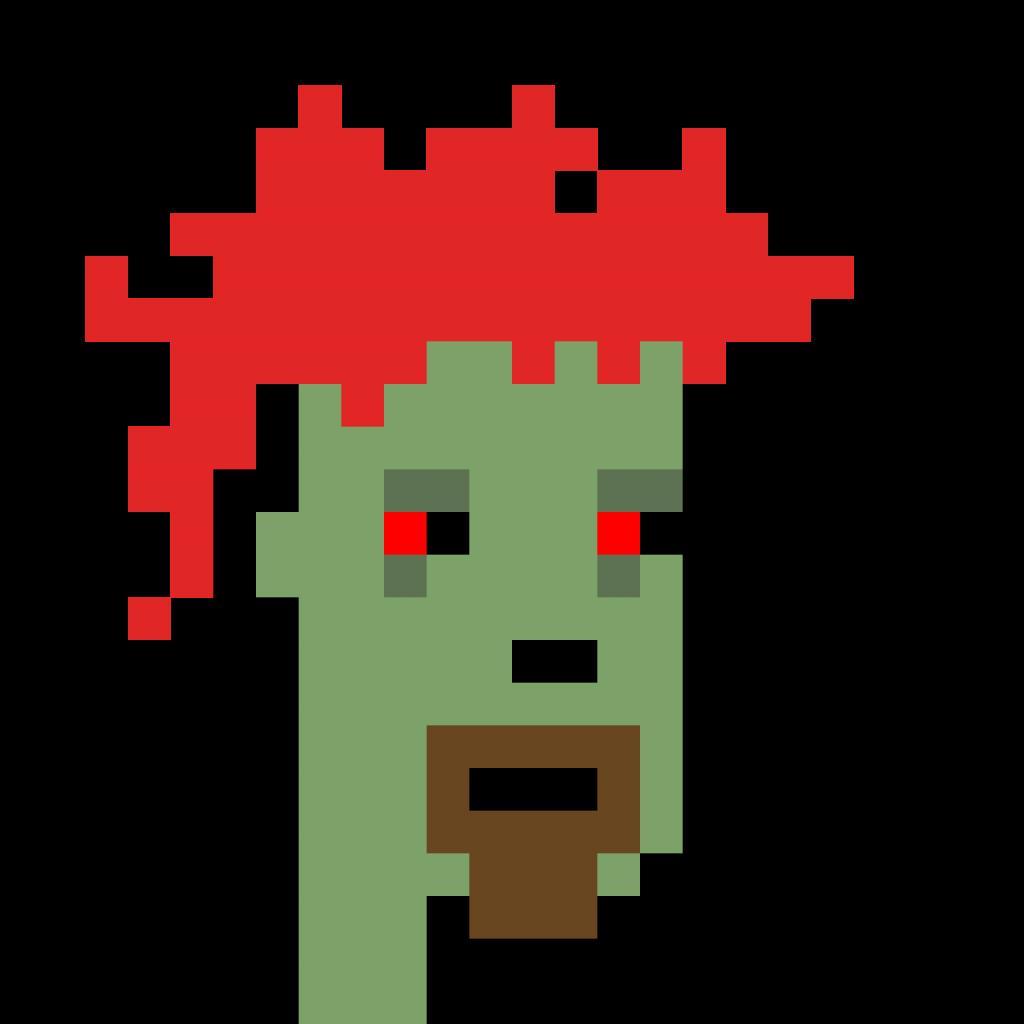

Larva Labs, (2020). Photo courtesy of Sotheby's.

Dimitri Cherniak has a series, in which the artist has designed 1,000 pieces that capture the endless ways a string can move around a peg, varying the number of pegs, shapes, swirling patterns and colors. Tyler Hobbs has two randomly generated Bachfeld works consisting of bent rectangles. Larva Labs played a trio of shows inspired by Sol Levitt, with Zombies serving as encore.

“This massive collection marks a watershed moment in the rise of generative art on blockchain in 2021,” said Michael Bohana, head of digital art and NFT at Sotheby's. "Since that tipping point, when digital art and NFT became true pop culture phenomena, generative art has continued to attract a wider audience."

While neither Sotheby's nor Teneo have been willing to provide sales estimates, timing of sales, and the scarcity of the pieces on offer, it is likely to fetch millions of dollars.

In February 2023, Teneo issued a notice detailing the company's NFT. Green identified more than 300 NFTs likely to be sold, including 30 from Hobbs, 17 from Cherniak, and 11 from Expect multiple sales over the summer.