It announced last year that it would charge a 30% tax plus applicable markup and a 4% tax on cryptocurrency trading profits. Image: Shutterstock

It announced last year that it would charge a 30% tax plus applicable markup and a 4% tax on cryptocurrency trading profits. Image: Shutterstock

Last year, Finance Minister Nirmala Sitharaman introduced cryptocurrency taxation for the first time during a budget speech by grouping private cryptocurrencies into virtual digital assets (VDA). However, this year, cryptocurrency was not mentioned in the February 1 budget speech. However, some new changes were later found in the fine print indicating a change in the tax at source (TDS) rules affecting VDA.

Last year, it announced it would charge a 30% tax plus applicable markup and a 4% tax on cryptocurrency trading profits. In addition, losses from some cryptocurrencies cannot be offset against gains from other cryptocurrencies and crypto transactions above Rs 10,000 were subject to 1% TDS under section 194S of the Income Tax Act.

This year, the Treasury Act mentions an amendment to the Income Tax Act under section 271C that would also penalize non-payment of TDS on virtual digital assets. This includes a fine equal to the unpaid TDS to be imposed by the Joint Commissioner, or imprisonment up to six months. In case of delay in payment, the interest for delay can be up to 15% per year.TDS is a direct tax collection mechanism in India. The Indian Income Tax Act, 1961 requires the payer to withhold a certain percentage of tax on certain payments to the recipient. Taxes must be deducted from payments such as commissions, interest, salaries, royalties, contractual payments, brokerage fees, etc. The reduced tax must be transferred by the payer to the tax authorities on behalf of the recipient. A penalty under Section 271C of the Income Tax Act can be levied if the payer fails to withhold and remit the tax withheld to the government, says Rishab Parah, a chartered public accountant and founder of NRP Capitals.

For example, if an investor fails to deduct Rs 1 million as TDS in a particular transaction, or even after the deduction has not been paid to the government, there will be a penalty of up to Rs 1 million or the same as before. it has not been seized or delivered into the hands of the government. In special cases, in addition to interest for delay, imprisonment may also be imposed.

Additionally, Section 194S states that if the transaction is through a crypto-pyramidal (P2P) exchange and not an exchange, the buyer has to pay a TDS deposit. “Footballs perform TDS settlements and deposits on behalf of their customers when you trade with them. Therefore, all crypto investors should be careful when dealing with TDS rules, otherwise they may end up in jail. For this reason, caution is required when investing in such a volatile asset class and certain tax rules must also be observed. Therefore, one should be careful not only when investing, but also when paying taxes," says Parakh.

See also: Cryptocurrency. What should we expect from the 2023 budget for digital currencies?

TDS penalties may be levied if the investor fails to withdraw TDS when he is likely to withdraw it. Earlier, TDS was not subject to the penal provisions of sections 271C and 276B relating to transactions between cryptocurrencies. The proposed budget aims to fill this gap, said Punit Agarwal, founder of KoinX, a cryptocurrency tax platform. "After this change in the budget, fear reigns in society. Investors can apply to the respective exchanges. It could also lead to a complete exit of investors from this asset class.

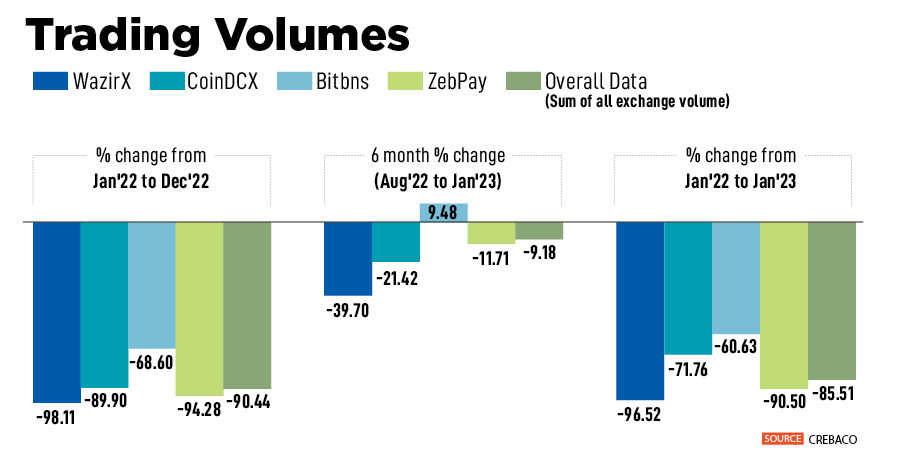

Since the introduction of the tax in 2022, there has been a sharp decline in cryptocurrency transactions in India. Between February and October 2022, cumulative trading volume of around Rs 32,000 crore was said to have shifted from domestically focused VDA exchanges to overseas exchanges. Over 17,000 users have switched to Forex to avoid taxes. As a result, Indian stock markets lost as much as 81% of their trading volume in the three-and-a-half months from July 1 to October 15, according to Esya Centre, a New Delhi-based technology policy think tank and Taxutra. B2B think tank. The portal.

Industry experts have demanded a regulatory framework as well as reduction of TDS to 0.1% instead of 1%. "If you make the ecosystem so complex, if we don't fix the system in time, we will lose, because bright minds are emerging and they have to do something extraordinary. The way this family implements TDS is too complex for everything. ecosystem. The entire Web3 ecosystem in India is not growing properly,” said Siddharth Sogani, founder and CEO of Crebaco Global, a cryptocurrency and blockchain market research and evaluation company.

According to Sogani, trading volume on Indian stock exchanges fell sharply, investors questioned the need to pay a 30% tax, and trading volume fell by 97%. The cryptocurrency market was also very heavy, the sentiment was bad, especially after the crash of FTX. As a result, trade has suffered. “Now that this sentence is approaching, we see the government targeting cryptocurrencies with online gambling and betting sites. He is more focused on games. The positioning of crypto with gambling and online games is wrong, it should not be a benchmark because they do not see the technology and the potential of startups,” he adds.

Gaurav Sahni, who has been investing in cryptocurrencies for over two years, says that taxing cryptocurrency profits is understandable, but they should lower the tax from the current 30% as it puts investors in the category of players. Additionally, unlike many other countries where earnings from cryptocurrencies are counted as capital gains and taxed under the same category, India still does not have regulations related to cryptocurrencies, but does have consumer protection regulations. Sahni started trading on Indian bourses and switched to the currency after last year's budget was announced.

See also: Cryptocurrency tax. Your best guide to the new rules

“Calculation of TDS for transaction-based traders is slightly different and Forex exchanges have the same rules for Indians and customers from other parts of the world. You cannot calculate TDS specifically for Indians,” says Sahni. A 35-year-old man who runs a family business selling car parts. Sahni does not intend to stop trading but will find other ways to avoid TDS. “This is not about tax avoidance, basically, if we pay 1% TDS each.

Sahni believes that blockchain technology will become more widespread in the future and cryptocurrencies are a way to promote blockchain technology in which developers are compensated for the projects they develop. “Crypto trading is not yet mainstream and most people in India still consider it a form of fraud due to the extreme volatility and fluctuations in cryptocurrency prices,” he says.

On February 4, Business Secretary Ajay Seth announced that regulations on crypto assets would be introduced later this year. “Crypto asset technologies, such as blockchain and others, can be used, but their use in the financial sector can create a number of risks. There will be action on cryptocurrencies this year,” he said at a post-budget press conference. in Bombay.

According to the 2023 Economic Outlook published on January 31, the market value of crypto assets fell from $3 trillion in November 2021 to less than $1 trillion in January 2023. Different countries' tokens and approaches to cryptocurrency valuation and regulation.

"Taxes from us are not a problem. But don't chain us to the fact that we live but cannot grow. Either stop completely or adjust completely. If you can't afford it, that's your problem, not ours. This does not mean that it is limiting the growth of the industry,” says Soghani of Crebaco Global.

Check out our festive offers of up to Rs 1000 on site subscription + Rs 500 gift card from Eatbetterco.com. Click here to learn more.