Wait what happened to the inverse correlation with the US dollar? Shouldn't the bitcoin and cryptocurrency market be dead now?

With the US Dollar Index (DXY) having a bit of a pump (well, it's up 0.58%), the cryptocurrency market takes many by surprise as it rolls around and stands on the sidelines with all its might.

So... what about FTX? Is this time different? Some traders are a bit worried about a potential bull trap…

However, it is not just about bitcoin and cryptocurrency. Wall Street closed higher overnight, with the S&P 500 up 0.14% and the Nasdaq up 0.68%.

Stockhead's Eddie Sunarto has some ideas as to what could happen, as he explained in his market analysis this morning.

"Instead of sliding into recession in the first quarter, the US economy looks resilient with retail sales rising to a two-year high in January," wrote our veteran markets and senior expert.

As you delve deeper into the world of cryptocurrencies, you will soon come across those who exude wild optimism.

And yes, that could be fine for sharing purposes, but here's a crypto zombie that thinks Bitcoin might be about to "really shock the world"...

Top 10 review

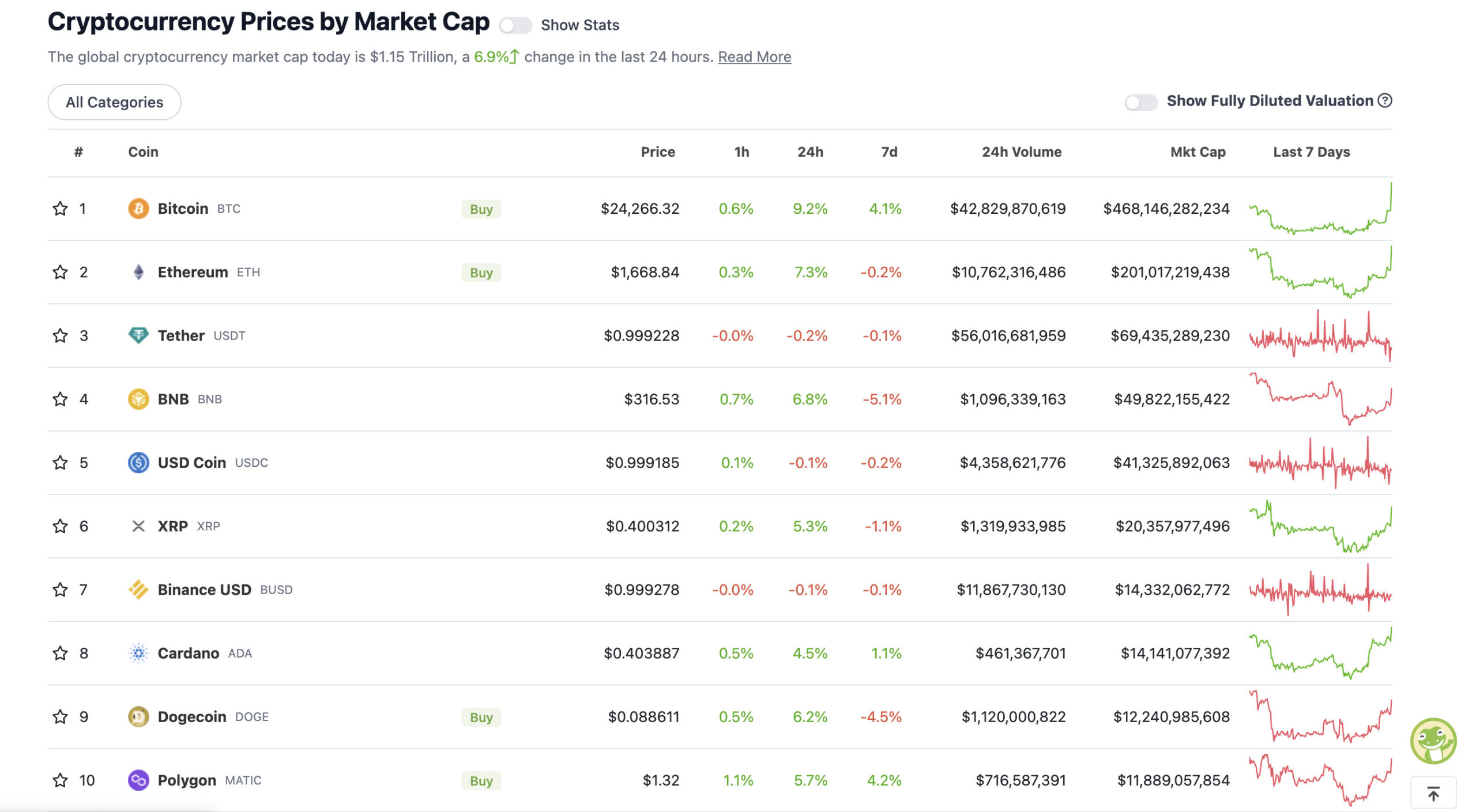

With a total cryptocurrency market cap of $1.15 trillion, up 7% from yesterday, according to CoinGecko, this is the current state of the top 10 coins.

Well check it out, Bitcoin (BTC) is actually the leader in daily gains right now, which is a good thing. In previous bullish waves, altcoin pumps have often followed Bitcoin's initial lead.

To soften this statement a bit... while Wells Fargo said that the "bear market is over" in stocks (which cryptocurrencies are closely associated with), that doesn't necessarily mean that the bull market is about to return.

Here's another major trader's call for caution, Gareth Solloway speaks here with Australian YouTube crypto expert and Twitter creator Miles Deutscher. Soloway believes that Bitcoin still has a long way to go before it really goes down this year, but he is bullish on 2024 and gold in his assets for 2023.

However, to continue to note the wild fluctuations in opinion on Crypto Twitter, here is another popular trader who goes by the name of Mustache. In his opinion, BTC could have a “divine candle” in the near future.

High and low: 11-100

After looking at the market cap range from $11 million to $475 million across the rest of the top 100, we've found some of the biggest gains and losses over a 24-hour period at the time of writing. (Accurate stats at time of publication based on data from CoinGecko.com.)

Daily pumps

• Bitget Token (BGB) (Market Cap: $646 Million) +20%

• Submission (RNDR), (MC: $609 million) +17%

• Optimism (OP), (LC: $604 million) +16%

• Mine Protocol (MINA), (TC: 1 billion USD) + 15%

• Rocket Ball (RPL), (MC: $894 million) +10%

There aren't many dips in the top 100 companies by market capitalization right now. In fact, the only thing that was slightly lower at the time of writing is the Baby Doge Coin (BABYDOGE) meme, which is a fraction of a percentage point lower.

Let's take a look at the list of market caps to see what happens now - a place where only the bravest cryptocurrency traders enter in this tense market...

• Conflux (CFX) (market cap: $203 million) +64%

• Floki (FLOKI), (MC: $360 million) + 58%

• Blur (BLUR), (MC: $331 million) +45%

• Lyra Finance (MC: $64 million) + 16%

Little-known Conflux (CFX) project, a top-tier blockchain that bills itself as a kind of bridge between the Western and Asian markets, has big news about the partnership. Conflux is said to be a regulatory blockchain in China and has apparently signed a master partnership agreement with China Telecom, according to the following tweet…

In the meantime, FLOKI can still keep up with Elon Musk's silly message from yesteryear. As for BLUR and LYRA, you can also read about them in recent Stockhead articles. Australia's largest fund, Apollo Crypto, is particularly bullish on Lyra Finance.

about blocks

Some of the themes and matches we left in the morning are traveling through the Crypto Twitterverse.

TLDR On SEC Commissioner Pierce Announcing SEC's Recent Move to Cryptocurrency, Changing Institutional Rules for Holding Cryptocurrency: It Doesn't Support This. It's not black and white, of course, but here's an excerpt from his long-running motivation:

"However, important aspects of the proposed approach and the timing of its implementation raise serious questions about the feasibility and comprehensiveness of the rule that I cannot support today's proposal."

Anyway... back to a lighter topic...

And here's Ulti Crypto, who recently spoke with Stockhead about their NFT downsizing project, Dyve. Maybe he won't be selling Ethlizard's NFT anytime soon?