© Getty Images illustrations by Binance via Jakub Porzycki/NurPhoto

© Getty Images illustrations by Binance via Jakub Porzycki/NurPhotoCryptocurrency exchange Binance has announced plans to buy rival FTX Trading, similar to the FTX bailout.

The owners of the two exchanges, Samuel Bankman-Fried of FTX and Changpeng Zhao of Binance, announced the deals on Twitter, but gave no details. The deal is still subject to due diligence, Zhao said on Twitter.

“FTX asked for our help this afternoon. There is a significant liquidity shortage," Zhao said on Twitter. "To protect users, we have signed a non-binding (Letter of Intent) that allows FTX to fully acquire and cover a liquidity crunch."

On Tuesday, Bankman-Fried thanked Zhao, who often refers to himself as “CZ,” and said the Binance acquisition would boost the crypto industry.

"This is a user-driven development that benefits the entire industry," Bankman-Fried tweeted. "CZ has and will continue to do an outstanding job of building a global crypto ecosystem and creating a free economy."

An unknown hacker accessed $570 million worth of cryptocurrency from Binance, but company officials estimate the loss was less than $100 million.

However, this deal will make Binance a more dominant player in the cryptocurrency space. Binance processes 1.4 million transactions per second and transfers $2 billion worth of crypto assets every day.

In comparison, FTX is the third largest exchange this week. Earlier this month, FTX opened a new headquarters in Chicago . Last year, the company acquired the naming rights to the former American Airlines Arena in Florida.

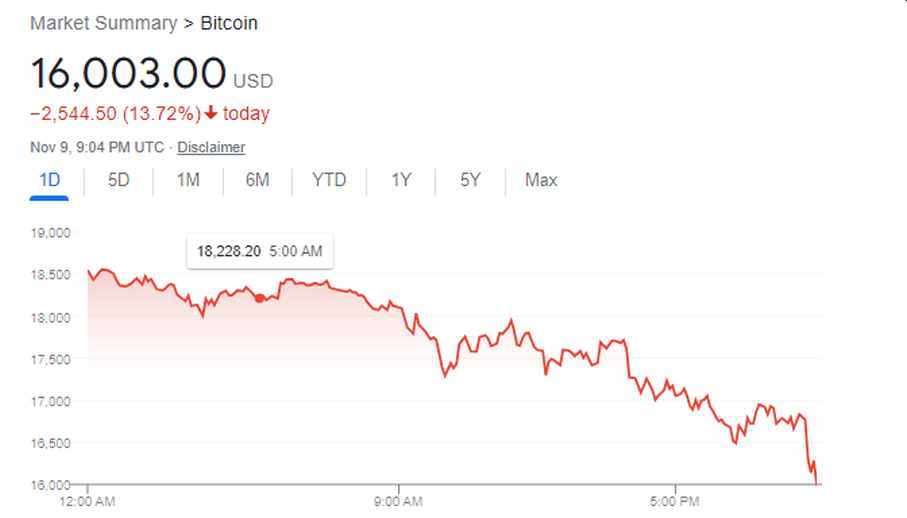

FTX is the latest cryptocurrency company to come under financial pressure this year as the value of crypto assets like Bitcoin and Ethereum plummeted. Binance said over the weekend that it plans to sell some of its own cryptocurrency, FTX, known as FTT, amid concerns that the company may be illiquid.

Most of the concerns with FTX stem from the effects of FTT. Bankman-Fried trading firm Alameda Research has a large exposure to FTT tokens, and the tokens are mostly not traded over the weekend. On Tuesday morning, cryptocurrency investors said they were also struggling to withdraw funds from FTX. The value of the FTT fell sharply to steady overnight after the deal was announced.

Other major cryptocurrencies were also higher after the deal was announced, with Bitcoin up 5%.

Bankmann-Fried, better known by his initials SBF, has been hailed as the savior of the crypto industry after pledging to buy crypto assets earlier this year to shore up the balance sheets of other failing crypto companies. This includes companies like Voyager Digital, which went bankrupt after holding a stake in the bankrupt stablecoin Terra.

Bankman-Fried bought a stake in online trading platform Robinhood after the company's stock plunged on declining earnings and losses.