Has the dust settled yet? No - FTX failure has several ways to resolve it. Meanwhile, Crypto.com has admitted a major religious error regarding its Gate.io crypto platform.

A cryptocurrency exchange, right? Already have a standalone cold storage wallet?

$400 million from Crypto.com

So… What is Crypto.com? (By the way, this phrase can have a strange meaning in the context of SBF - see more about this.)

This is the leader behind FTX's spectacularly chaotic crash, with industry insiders such as Binance Exchange CEO Changpeng Zhao and Ethereum founder Vitalik Buterin urging cryptocurrencies to find a transparent way to show the world their effectiveness and fundamentals.

Backup folder, name it. It is actually an encryption protocol developed by Buterin.

Yesterday it was revealed that the small giant Crypto.com cryptocurrency exchange, Gate.io, sent 320,000 in ETH and Gate.io later returned the funds.

Speculations have been rife on Twitter that the two exchanges are trying to increase Gate.io reserves in real-time with an audit check similar to a backup credit check.

Incidentally, another popular exchange, Hopi, has been decommissioned amid the same allegations, details from Cointelegraph can be seen here.

In an attempt to explain Crypto.com's side of the story, CEO Chris Marsalek said the clerics made a mistake in sending money to Gate.io. But that actually happened three weeks ago —before the FTX blew up and every new security clearance call.

At that time, the transaction value of 320,000 ETH was around $400 million.

Gate.io has been publishing audit guidance for backup types for several years. The last image of the exchange was taken on October 19, two days before Crypto.com accidentally transferred 320,000 ETH to the fund.

Crypto.com's Chris Marszalek tries to further dispel the fear, uncertainty, and doubt (FUD) that is spreading rapidly in this situation.

Here he also addresses the question of why 20% of the exchange reserves are held in Shiba Inu Meme Coin (SHIB). Yes, it's the top 20 cryptocurrencies, but dog meme coins have a lot of interest.

With the cryptocurrency market completely shocked by the brutality of FTX, managing FUD coin stocks and how to manage them on some of these platforms is going to be very difficult.

Like FTX, Crypto.com, which has a 20-year, $700 million deal to license the legendary LA Lakers stadium, is a major player in the cryptocurrency exchange space. Damon and LeBron James.

FTX... "what"?

Before we look at the real health of the market, the value of bitcoin, what's the latest on the FTX explosion?

We last mentioned in this column yesterday that former FTX CEO Sam Bankman-Fried and several other FTX executives were investigating authorities in the Bahamas, where the cryptocurrency exchange is based. .

It's an ongoing situation, but at least we can assume that Panman Fried and some of his friends are still around and haven't run off to Dubai, Argentina, or some faraway place in the Bermuda Triangle.

But here's something annoying and/or annoying. According to Decrypt , FTX's sister company and trading company Alameda Research used its knowledge to list the tokens on the FTX exchange.

According to an analysis by crypto compliance firm Argus, Alameda bought the tokens before FTX's public announcements and then resold them for a profit.

Ah, if that's true... well, I don't know what happens next, but we all know how it ended on Wall Street for Bud Fox and the real monster of Wall Street , Jordan Belfort.

The article takes place between early 2021 and March of this year, Alameda claims to have listed 18 different tokens worth $60 million on FTX.

Meanwhile, what happened to Bankman-Fried's Twitter account?

Follow: APPEN

What's going on? Tell me my friend

Crypto thinks Twitter is trying to tell us something—perhaps about former Alameda Research CEO Sam Trabuco, who resigned in August but remains an adviser?

A look at the top 10

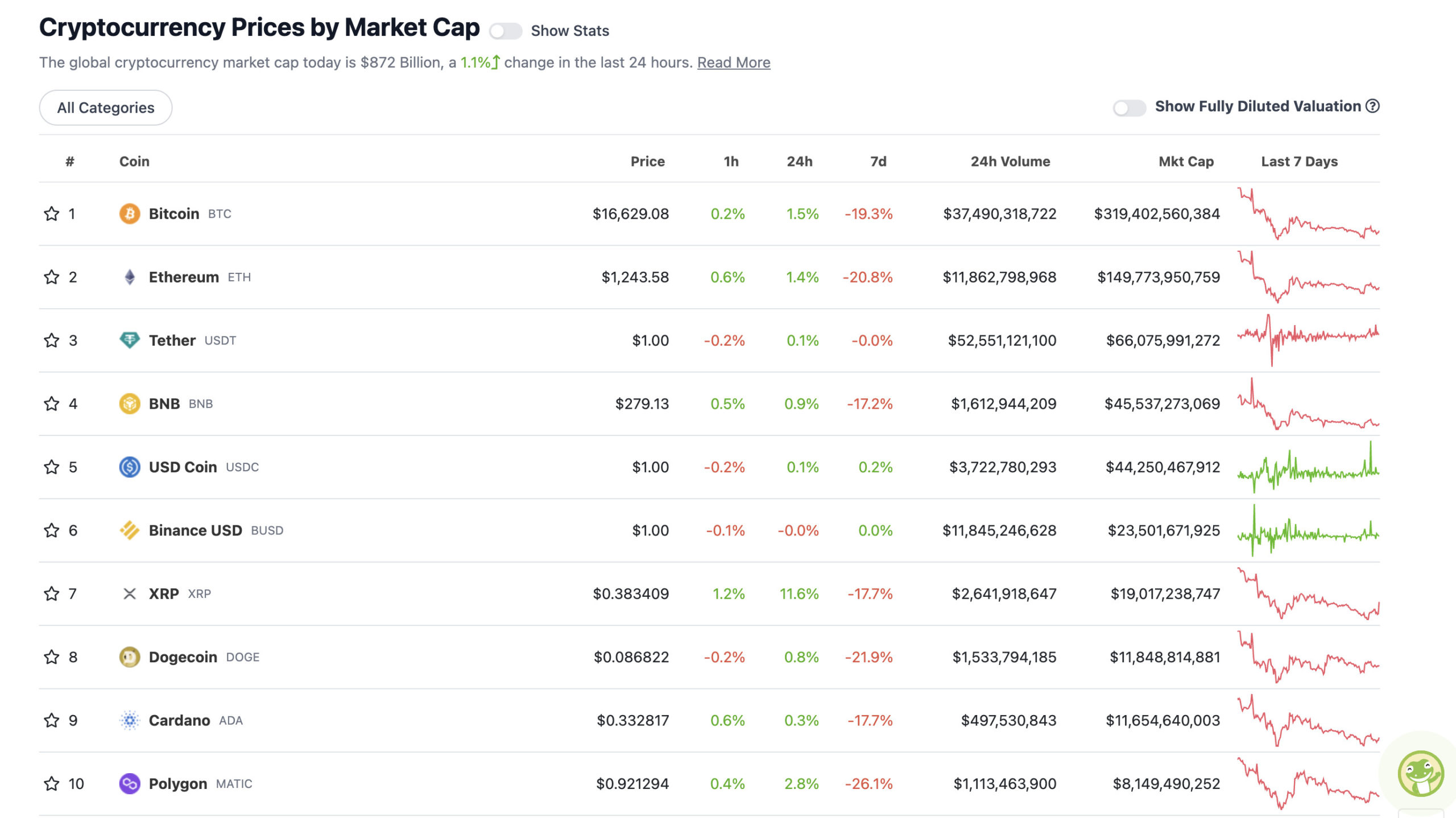

The total value of the cryptocurrency market is $872 billion and has increased by 1% since then, and here is the situation of under 10 coins - according to CoinGecko.

Does the entire cryptocurrency market have a percentage point? Looks like a win. We will take it

Bitcoin and Ethereum set the bar for the rest of the major cryptocurrencies today, and XRP disappeared with them. It is up more than 11% in the last 24 hours.

Any word on the SEC lawsuit? Well, news of an impending settlement at work primed the pump. But hold your horses...they might be mislabeled.

In the following Fox Business segment, neither the host nor the respondents mention the settlement, but the Chiron chart appears: "SEC VS. RIPPLE SETTLEMENT EXPECTED TOMORROW.

The things that keep you going…

Above and below: 11-100

Let's take a look at the top gainers and losers over the 24 hours at press time, as another 100 have been eliminated with market caps ranging from about $6.86 billion to $320 million. (Statistics corrected at time of publication based on data from CoinGecko.com.)

daily push-ups

• Syntex (SNX), (market cap: $437 million) +17%

• Kronos (CRO), (MC: $1.81 billion) +18%

• Trusted Wallet (TWT), (mc: $946 million) +15%

• dYdX (DYDX), (MC: $342 million) +9%

• GMX (GMX) (MC: $348 million) +9%

daily skis

• Tokenize Xchange (TKX), (market cap: $741 million) -4%

• LEO Token (LEO), (MC: $3.5 billion) -4%

• BTSE Token (BTSE), (mc: $587 million) -2%

Dow Curve (CRV) (MC: $386 million) -1%

about the blocks

Rumors, rumours, luck and a choice of honesty guide our morning actions in the Crypto Twitterverse…

TLDR of the following tweet from legendary trader Gareth Soloway (who was named head of the crypto market last year)… He expects the market to drop around $9-10,000 in bitcoins within 5-6 months.

However, predictions - a grain of salt and everything can be.